Statutory earnings refer not only to your monthly salary but also to commissions bonuses allowances benefits. 22 Travelling allowances.

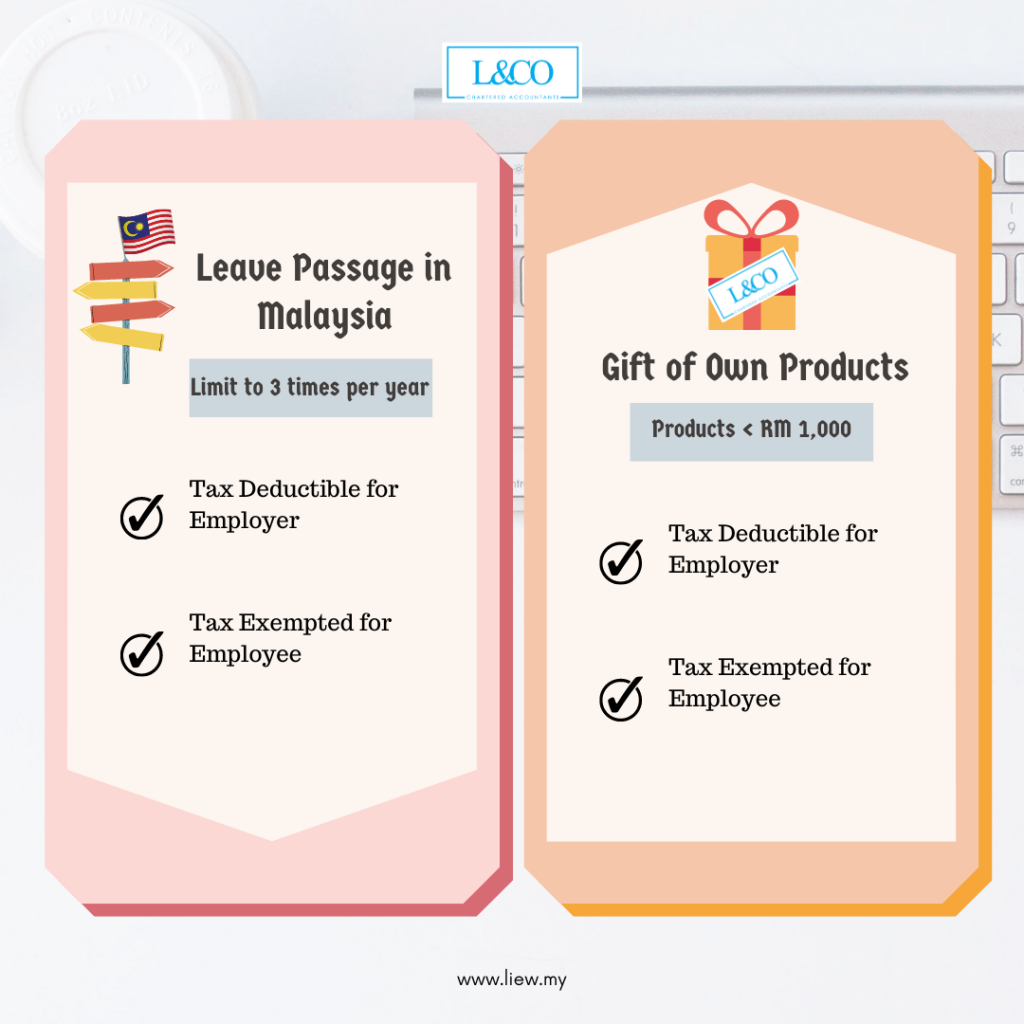

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

A perquisite is a perk or benefit given to you by your employer like travel and medical allowances.

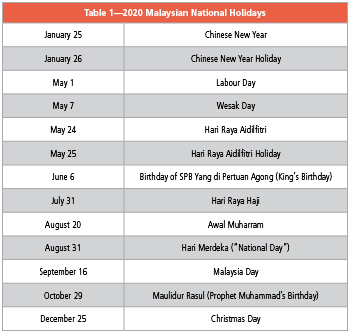

. 3200 per month. The exemption is effective from year of assessment 2008 to year of assessment 2010. Income of a non-resident from an employment in Malaysia is exempt.

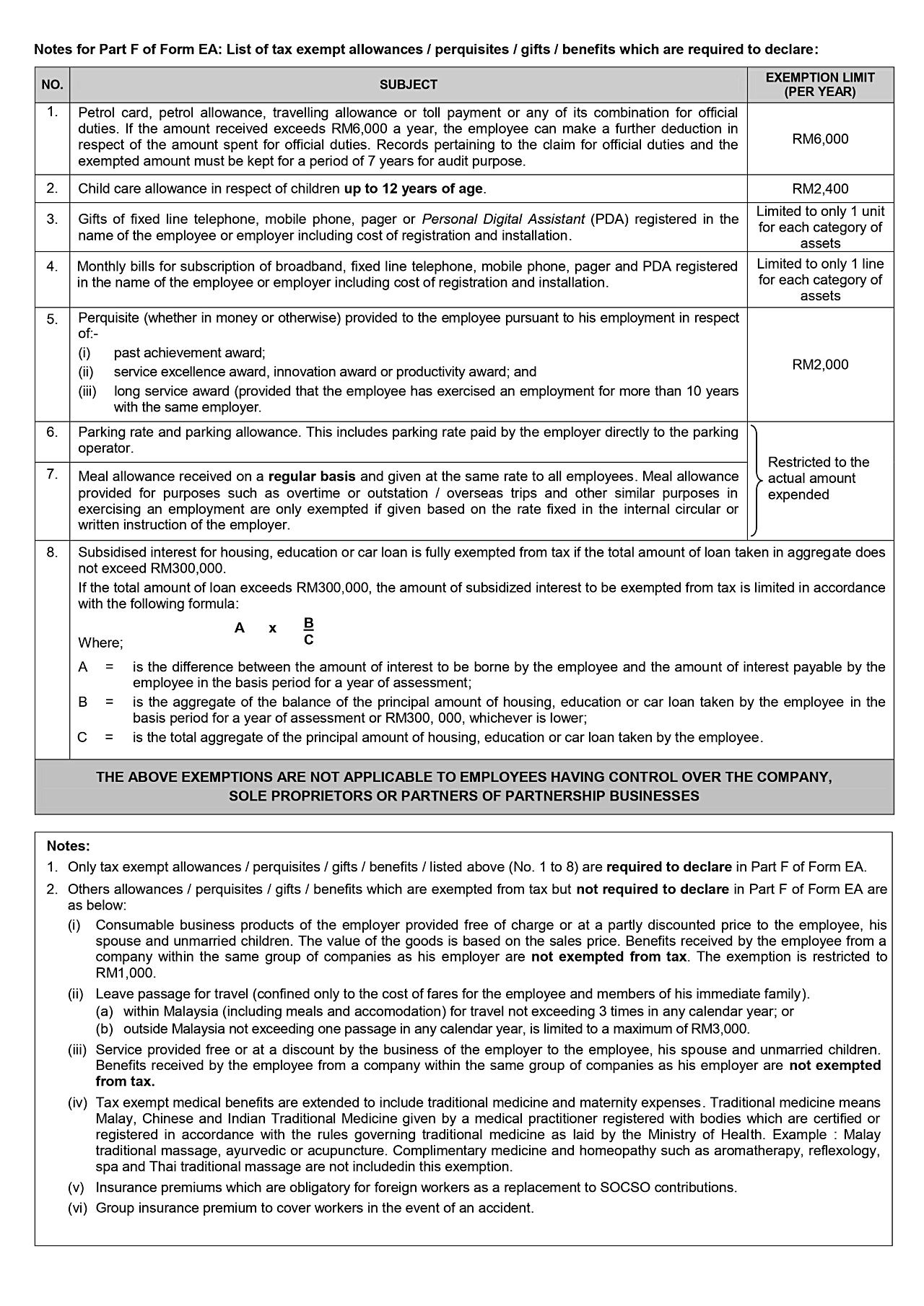

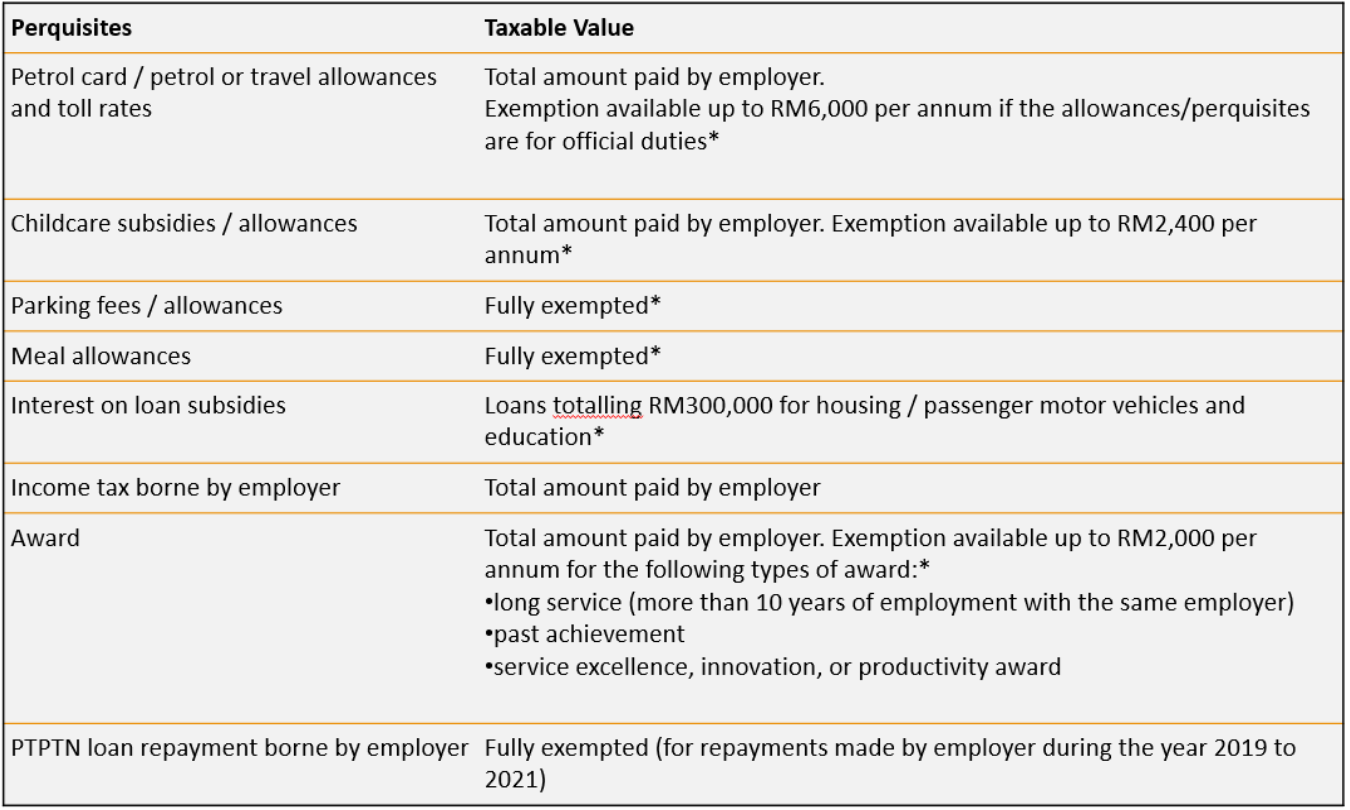

Petrol card petrol or travel allowances and toll rates. If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of the amount spent for official duties. This may include the fixed transport allowance you mentioned.

EXEMPTION LIMIT PER YEAR 1. Records pertaining to the claim for official duties and the exempted. In Malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company.

Petrol allowance petrol card travelling allowance or toll payment or any combination. This may include the fixed transport allowance you mentioned. Personal Income Tax Relief up to RM1000 for domestic travel expenses.

In late February this year it was announced under the 2020 Economic Stimulus Package that Malaysians who travel locally can enjoy special personal income tax relief up to RM1000. And under the PENJANA Economic Recovery Plan that was recently announced on 5th June 2020. Petrol cardpetrol or travel allowances and toll rates.

Tax exempt up to RM6000 per year. Please note that the exemption is applicable for years. Petrol allowance travelling allowance and toll payments in the line of official duties can be exempted at a limit of RM6000 per year.

Below are some examples of perquisites. Includes payment by the employer directly to the parking operator. Includes payment by the employer directly to the childcare provider.

Petrol allowance travelling allowance or toll payment or any of its combination for official duties. If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of the amount spent for official duties. Exemption amount of 70 of such allowance or 10000 per month whichever is.

Exemption available up to RM6000 per annum if the allowancesperquisites are for official duties Childcare subsidies allowances. Petrol allowance travelling allowance or toll payment or any of its combination for official duties. Fuelgas card or travel allowances and toll rates Hello if my employer gives me an allowance for my car loan and apartment is it tax-free.

Tax exempt up to RM2400 per year. Income tax allowances and deductionsSpecial allowances and deductions available for an employee transport allowance of Rs 1600 per month are exempt from tax for an employee. This refers to the claims made by employees who are using their personal vehicle for official duties.

Here are some examples of benefits. Travelling allowance or petrol allowance received by an employee for travelling from home to place of work and from place of work to home is exempted up to an amount of RM2400 per year. Transport allowance for employees of transport business for covering personal expenditure during the running of such transport.

Find out the scale rate expenses for accommodation and subsistence paid to employees who travel outside of the UK. Total amount paid by employer. You are given a tax exemption of up to RM2400 a year if your employer pays you a travel allowance that means this benefit will not be declared in your tax return.

There are many types of allowances officially confirmed by LHDN as a tax-exempt allowance LHDN Inland Revenue Board of Malaysia. Salary bonuses allowancesbenefits Tax benefits for foreign workers in Malaysia expatriates. If the travel allowance paid is less than RM2400 a year then the exemption is the actual amount of travel allowance paid.

Any amount received more than Rs1600 is taxable. Here are the 14 tax exempt allowances gifts benefits perquisites. Allowances 321 Travelling allowance petrol allowance or toll rate i.

23 Benefits in kind exemptions. Total amount paid by employer. Exemption available up to RM2400 per annum.

Exemption up to RM6000 per year if the allowancesbenefits are for official duties A benefit is a benefit or benefit provided to you by your employer such as travel allowances and medical allowances. Petrol allowance petrol card travelling allowance or toll payment or any combination. Tax exempt as long the amount is not unreasonable.

Travelling allowances of up to RM6000 for petrol and tolls are granted a tax exemption if the vehicle used is not under the ownership of the company. Exemption available up to RM6000 per annum if the allowancesperquisites are for official duties. Records pertaining to the claim for official duties and the exempted amount must be kept for a period of seven years for audit.

Transport allowance to commute from place of residence to place of dutyoffice for physically challenged employees. Total amount paid by employer. Exemption available up to RM6000 per year if allowancesbenefits are intended for official functions Cash compensation eB.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Updated Guide On Donations And Gifts Tax Deductions

Bdo Malaysia The Covid 19 Outbreak Has Without A Doubt Impacted The Global And Malaysian Economic Scene In Light Of This The Government Has Announced The 2020 Economic Stimulus Package With The

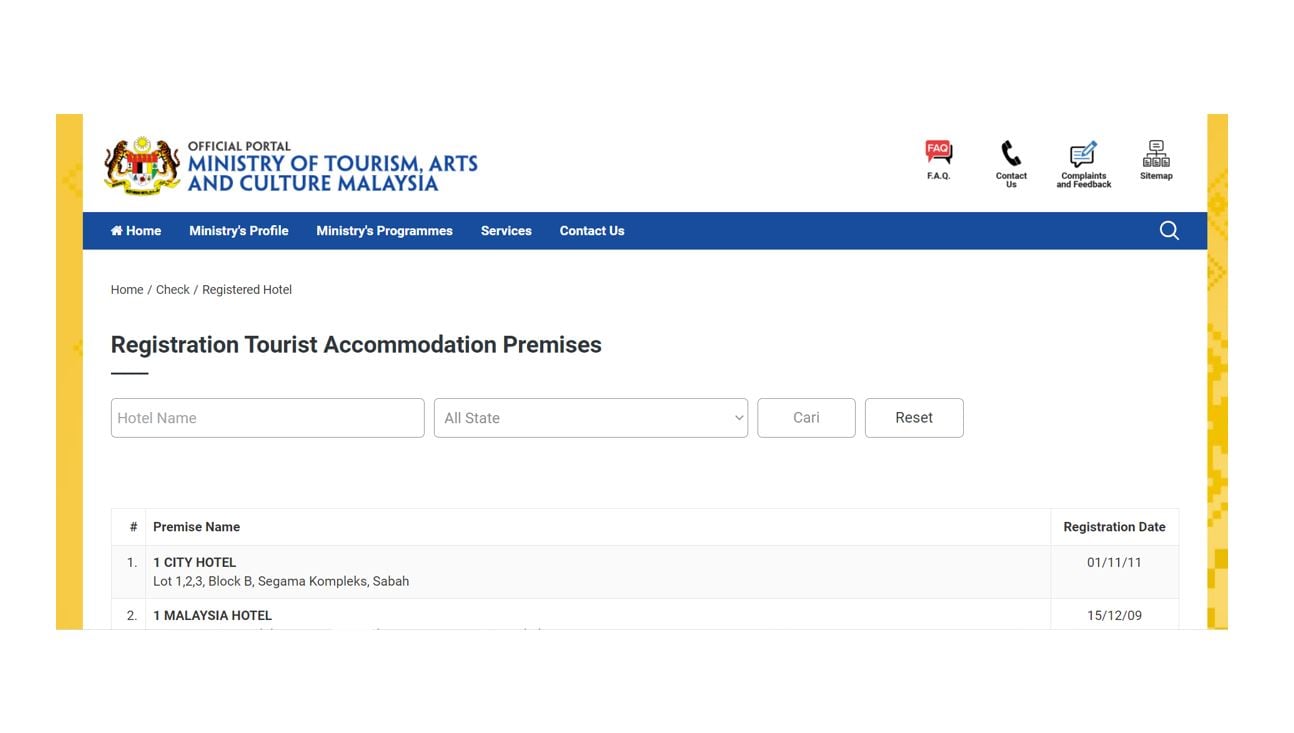

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Tax Exemption On Leave Passage Vacation For Staff Benefit Kclau Com

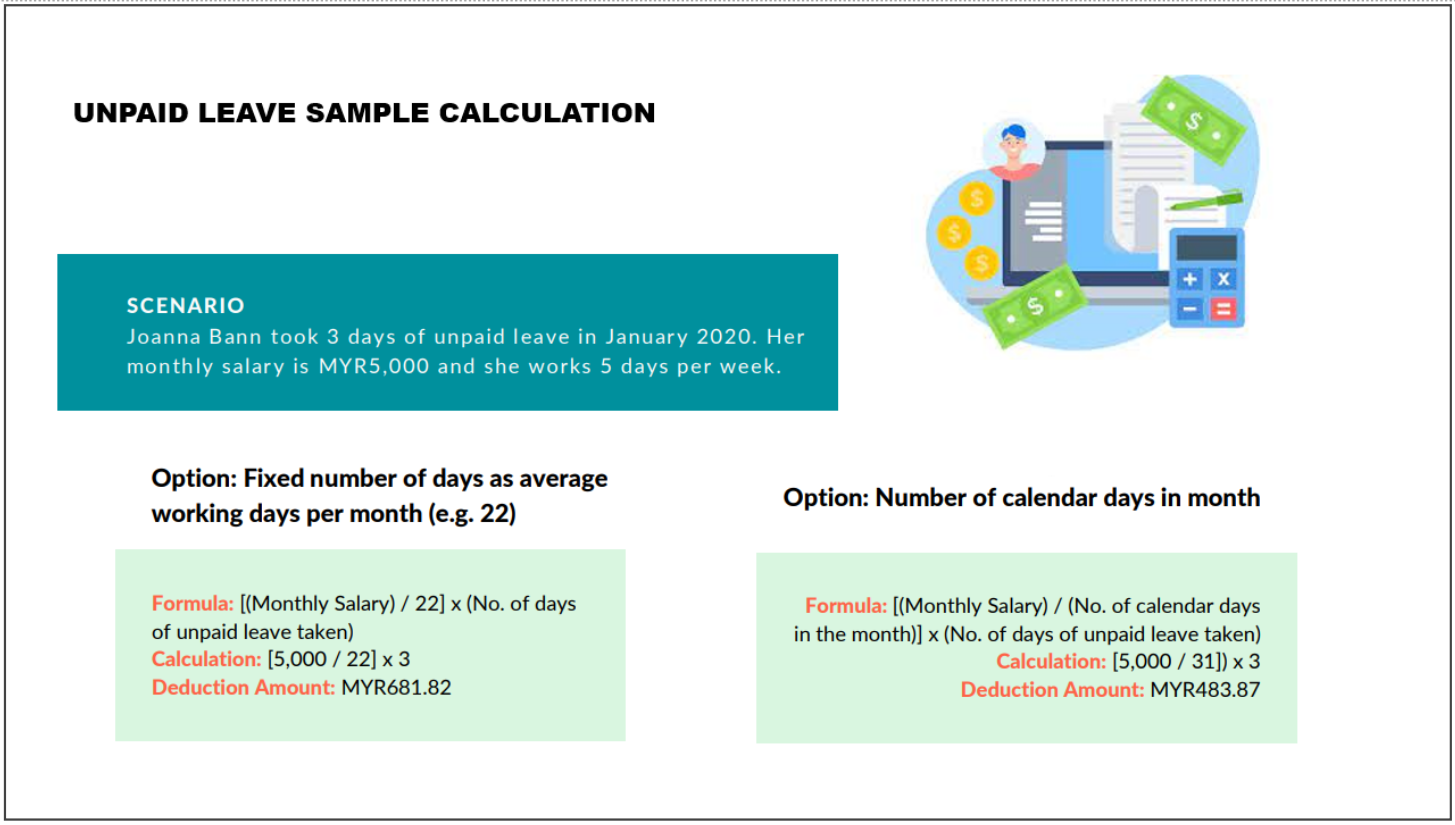

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

What You Need To Know About Payroll In Malaysia

Which Benefits Are Tax Exempt For Employees In Malaysia Ya 2021 Althr Blog

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

Everything You Need To Know About Running Payroll In Malaysia

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

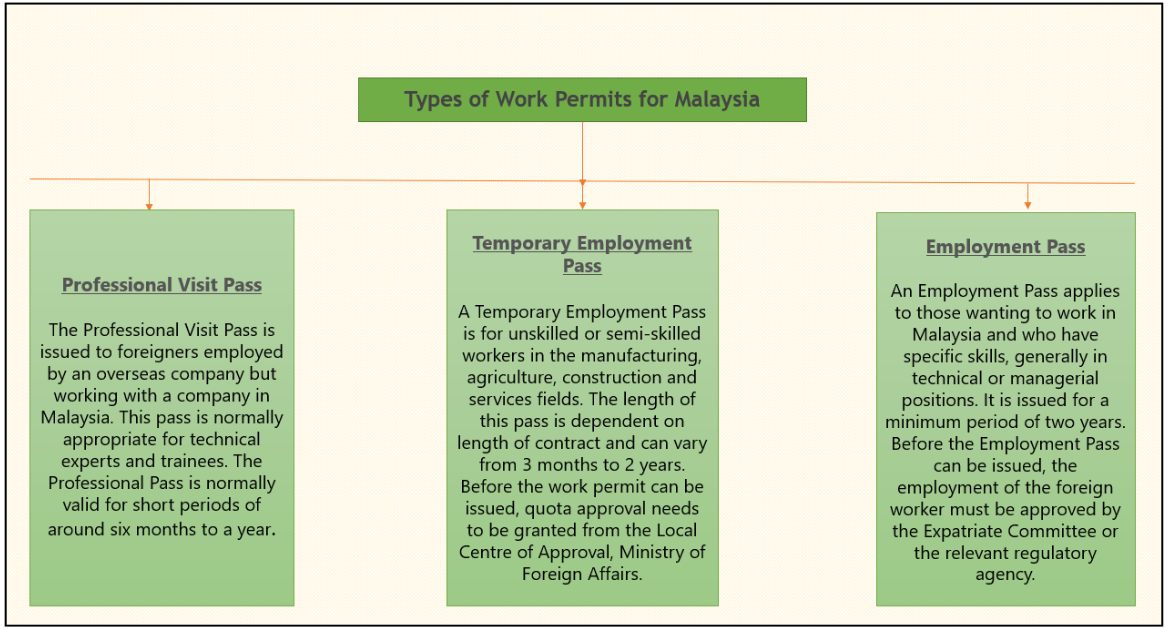

Individual Income Tax In Malaysia For Expatriates